On average, each American carries a credit card debt of approximately $5,525, per the Experian State of Credit 2021. Furthermore, nearly half of Americans have nothing saved in their 401(k). “78% of adults live paycheck to paycheck, and 3 in 5 adults do not maintain a monthly budget.” – NBC. Despite the government’s effort to require students in 21 states to take personal finance courses to graduate high school, the alarming data shows otherwise.

Most high school students in the US have to make one of the most expensive purchases decisions at a young age: College. To college costs into perspective, among the Class of 2018, 69% of college students graduated with loans and an average debt of $29,800.

To bring awareness to this topic, we want to release this article discussing aspects of personal finance, as well as giving high school students a comprehensive guide to financial literacy. So, any interested high school student can know where to get started. Regardless of the major, you plan to select in college, we strongly recommend you receive a jumpstart learning about money and how to manage money like a boss.

1. What is personal finance and why does it matter?

Personal finance is a broad term covering multiple aspects of finance, but its sole purpose is to meet personal financial goals, whether it’s short-term financial needs or long-term wishes. Personal finance has 3 main aspects; save, manage, and invest.

The reason it’s called personal finance is that the financial plan is based on your budget and your own financial situation. How a young professional in their 30s budgets their money is different from a recent college graduate. Therefore, you shouldn’t compare yourself to other people while doing personal finance.

The term financial freedom has been discussed frequently. The ultimate goal is to achieve financial freedom, which is the freedom from financial debt and the ability to control your life without the overwhelming stress about the financial impact.

2. Personal finance education in high school

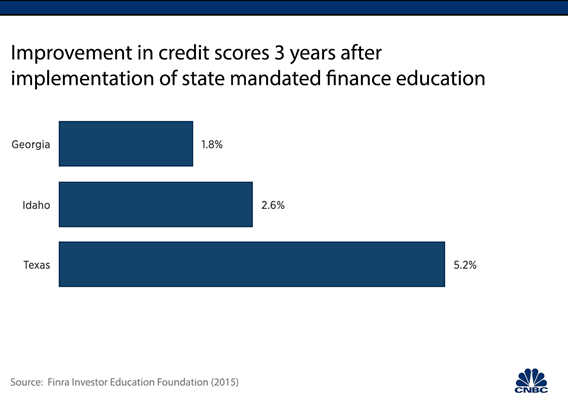

US public high school curriculum in the past only included standard subjects like Science, Literature, and History, which has become outdated and not stayed current with the advancement of society and technology. According to NBC, states have started enforcing the requirement for personal finance education, which led to positive results 3 years after the implementation. However, the truth is only 6 states provide a semester-long, stand-alone courses, while some states provide shorter courses or include the content as part of another class.

With a stronger personal finance lesson plans, students will be better prepared with knowledge and understanding of loans and financial aid when facing that decision at the end of senior year in high school. Students will also discover scholarship and fund opportunities, as well as the knowledge to manage their academic and personal budgets.

For students and parents interested in seeing which schools offer financial education, head to Check Your School, an initiative of the JumpStart Coalition.

3. Guide to personal finance

Budgeting and Savings

The most critical first step is budgeting and savings. The two terms go hand in hand because with proper budgeting, you will have savings. Then, when you have savings, you can budget for your short-term and long-term expenses better.

Before going onto budgeting, you should set short-term goals and long-term goals. By setting up and being committed to achieving these goals, you will have the motivation and determination to budget parts of your income into these goals rather than spending it all.

Some examples of the short-term goals can be:

- Have an emergency fund of $3,000 or at least three months of living expenses

- Save $500 to buy a PS5 Console

Some examples of the long-term goals can be:

- Start saving money to cover 10% of college tuition cost

- Start saving money to buy your first car and 1 year of car insurance

Depending on your personal needs, you may have only short-term goals and no long-term goals, or vice versa. In order to budget money, there are a few simple steps:

- Calculate your monthly income and expenses

- Choose a budgeting method that works for you

- Monitor your progress throughout the time period to achieve your goals

Calculate your monthly income and expenses

Many high school students don’t have a consistent after-tax income; however, you should still try your best to estimate how much money you receive and how much money you spend each month. If your parents give you a monthly allowance, that money can also fall under income to make it easier to budget everything later.

Choose a budgeting method that works for you

There are four main budgeting methods:

- The 50/30/20 budget is the most popular one. The 50/30/20 splits your income into 3 different categories: 50% goes to necessities, 30% to wants, and 20% to savings (and debt repayment). You can do a quick calculation here on NerdWallet platform, or any method that you prefer

- The envelope system: This budgeting method allows you to set a spending limit for each category (groceries, makeup, clothes, takeout, etc.). Once you reach that spending limit — or when your envelope is empty, you can’t spend more money in that category until the end of the month

- Pay yourself first: With this, you have the freedom to set aside your amount of choice into saving goals. Then, you can use the rest for whatever you need

- Zero-based budget: This budgeting method allows you to use every dollar deliberately in expense and savings – until there are zero-dollars left.

Monitor your progress:

At the beginning of this budgeting and saving process, you will find it hard to keep track of everything. Moreover, sometimes you will be too loose with yourself and not fully commit to the process. In the beginning, we recommend you go harsh on yourself, by closely tracking your progress with budgeting apps and tools. After a couple of months, you will get used to it and start to automate the process, making savings so much easier.

There are so many budgeting apps out there to help you with budgeting and savings. Examples include: Mint, Acorns, Wally, NerdWallet. Depending on your personal needs and wants, you can choose a budgeting app that suits your needs. If you don’t want to share data with budgeting apps, you can always choose to budget with Excel.

Bank Accounts

Bank accounts are so important for you to use debit/credit cards, use payment apps like Venmo or Cash App, use ATMs, receive paychecks from employers, etc. However, 6% of households in the United States don’t have accounts. There are three types of accounts you should open with a bank that serve different purposes:

- Checking account: A checking account is for you to make deposits and withdrawals. Normally, you shouldn’t put a lot of money into this account, because the checking account is mainly to cover small purchases.

- Savings account: A savings account is where you save money. When using any budgeting strategy, you can send parts of your income to this account. A savings account is an interest-bearing account. So, the money you put into a savings account can generate more money; however, the interest rate is normally very low. Some banks like Ally Bank, Synchrony, or Capital One 360 offer higher rates, the best savings account interest rates can be reviewed on Bankrate.

- Another account you can open is your fixed-cost account. This account makes more sense once you move to college or start living independently. This account is mostly to pay for fixed expenses: rent, electric, internet, cell phone, etc. This account is great way for you to keep track of your cost of living monthly.

With these three accounts, you can have a much better overview of your spending and saving habits. Since you are a high school student now, you won’t have significant spending and savings. However, developing the habit of budgeting and saving will help you significantly in the long run when you have to be responsible for bigger expenses.

Credit Cards

While a debit card allows you to spend the money you have available, a credit card allows you to spend the money you don’t have — which is the money you borrow from the card issuer, and you must pay it back over time with interest. If you pay your credit card balance in full each month, you do not incur interest, however most people do not do this.

There are pros and cons of credit cards, as well as different types of credit cards for students to choose from. While credit cards allow you to borrow money and not have to pay it back right away, the mentality of ‘not my money’ can lead you to credit card debt snowballing over time. However, if you pay your bills on time, credit cards are a great way for you to build credit history and earn a great credit score. A great credit score can help you get more favorable interest rates on car loans, personal loans, and mortgages later in life.

Does it sound very far away for you? It is, because you are not going to take out a loan to buy a car anytime soon, likely not until college or after. However, as we mentioned, a credit score is built over time, not overnight. Therefore, having a stable credit score through opening accounts with good financial institutions and making consistent payments will make your life so much easier once you reach college.

Investing

Now that we have covered money management and saving, we will move on to probably a more exciting part of personal finance: How do I make more money?

There are three ways you can make more money in addition to your status as a full-time student:

- You can take part-time jobs

- Create a product/service that can turn into a passive income

- Investing

Part-time jobs are pretty standard for students already; therefore, we won’t dive deeper into this.

Passive income is another stream of income that you can have while you are a student. We have provided a few ideas for students who generate passive income through creating a new product/service from what you are interested in— 6 Unique Business Ideas for High School Students

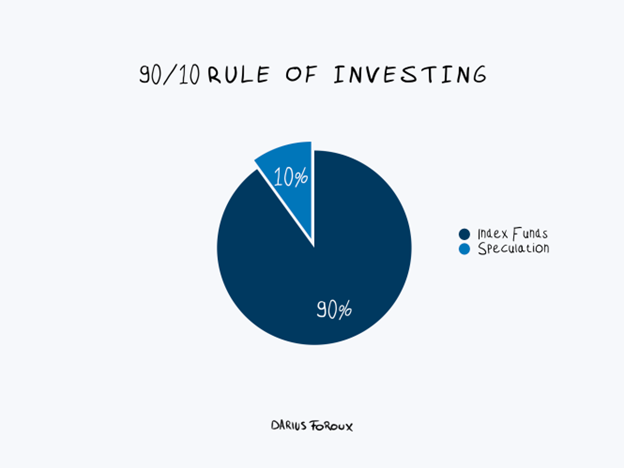

The third stream of income for students is investing. However, if you are under 18, you can make investments only under the supervision of your parents through a custodial account. Therefore, you won’t be able to use a riskier investing strategy and have the freedom to invest in anything. In this case, we suggest that you should invest using the 90/10 rule, which means you use 90% of the money invested dedicated to index funds, and the remaining 10% in normal stock investments. An index fund is a guaranteed return in investment in the long term because it tracks the returns of a market index, like the S&P 500. You can read more about index funds and other funds on the internet. We won’t be able to cover everything about it since it will take pages. The rest 10% can be put in any stock investment that you feel confident about after researching.

Identity Theft

With the expansion of the digital world and online shopping, people are more and more vulnerable to identity theft through email, text messaging, and social media. Because your phone numbers and email are also used for financial transactions and storing financial information, hackers can use that information to scam and defraud you.

There are several preventative measures students can take to minimize identity theft, such as turning on two-factor authentication for all accounts, using a complex passwords through a password manager, or using the “Hide my email” service provided by iCloud (using a different email address for services but emails will be directed to your main inbox), or change passwords frequently. By no chance, will this 100% protect you from identity theft, but these are the best possible solutions to protect your personal information and your finances.

Those are the basics of personal finance for high school students we believe you should be aware of. Once you develop the habit of managing, saving, and investing your money, you will have an easier time handling bigger expenses and bigger loans in the future. We hope that with this guide, you won’t feel intimidated but inspired to be a better spender, saver, and investor!

For students who are interested in learning more about a bigger picture of finance and economics, for example, macroeconomics or economics in general, we have just the right class for you!

Further reading:

Economics Research

Students will use college-level economic theory and models to analyze the financial impact on the global economy. The economic instructor will provide students with the models and tools necessary to write an economic research paper. The economic research project encourages students to integrate their acquired knowledge of economic theory, phenomenon, data, and policy.

Introduction to Economics

This course is designed to give students a basic understanding of the fundamentals of Economics. Of all subjects learned in the secondary setting, the fundamental principles of economics are essential. Students will apply economic principles to everyday scenarios during this course. They instructor will assist students to think economically and make rational decisions.